california mileage tax rate

Web Beginning on January 1 2021 the standard mileage rates for the use of a car also vans pickups or panel trucks will be. 56 cents per mile driven for business use.

New 2022 Irs Standard Mileage Rates

Web Additionally taxpayers earning over 1M are subject to an additional surtax of 1 making the effective maximum tax rate 133 on income over 1 million.

. Under California Labor Code 2802 employers are required to reimburse employees for necessary expenses incurred in executing their job. 585 cents per mile driven for business use up. Web California mileage rate in 2022.

California also pumps out the. Web Reimbursement Rate per Mile. Web Wednesday June 22 2022.

California Considers Placing A Mileage Tax On. 2021 the internet website of the california department of tax and fee administration is designed developed and maintained to be in. If you have questions.

Web Rick Pedroncelli The Associated Press. Web The Standard Auto Mileage Rate For Reimbursement Of Deductible Costs Of Operating An Auto For Business Will Be 585 Cents Per Mile. Please visit our State of Emergency Tax Relief page for additional.

Web California Mileage Tax Rate. Web The Division of Workers Compensation DWC is announcing the increase of the mileage rate for medical and medical-legal travel expenses by 4 cents to 625 cents. Private Aircraft per statute mile.

Click on the Calculate button to determine the. Gavin Newsom a Democrat signed legislation Friday expanding a pilot program that charges drivers a fee. 585 cents per mile driven for business use up 25 cents.

Web 15 rows The following table summarizes the optional standard mileage rates for. As of January 2021 the Internal Revenue. Web The reimbursement rate changes every so often depending on the fixed and variable costs of operating an automobile.

Web Effective January 1 2021 the personal vehicle mileage reimbursement rate for all state employees is 56 cents per mile. Web The new rate for deductible medical or moving expenses available for active-duty members of the military will be 22 cents for the remainder of 2022 up 4 cents from. Web Beginning on January 1 2022 the standard mileage rates for the use of a car van pickup or panel truck will be.

Web In California employers are required to reimburse workers who use their personal vehicles for business purposes are compensatedThere are 4 ways to calculate. Web Carl DeMaio and Reform California hosted a forum on the mileage tax in La Mesa last week drawing a crowd of 200 residents. 0625 per mile from July 1 to December 31 2022.

0585 per mile from January. Personal Vehicle state-approved relocation 016. Personal Vehicle approved businesstravel expense 056.

Web Select your tax year. Web Beginning on January 1 2022 the standard mileage rates for the use of a car also vans pickups or panel trucks will be. Input the number of miles driven for business charitable medical andor moving purposes.

The official IRS business mileage rate for 2022 is. Web Businesses impacted by recent California fires may qualify for extensions tax relief and more. Web The standard mileage rate for 2021 taxes is 56 cents per mile driven for business 585 cents per mile for 2022.

The Current Irs Mileage Rate See What Mileage Rates For This Year

Company Mileage How Are Mileage Rates Determined

Irs Increases Standard Mileage Rates Starting July 1 2022 Stinson Llp Jdsupra

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

What Are The Mileage Deduction Rules H R Block

Irs Raises Standard Mileage Rate For 2022

Mileage Log Template Free Excel Pdf Versions Irs Compliant

The Current Irs Mileage Rate See What Mileage Rates For This Year

Sandag S Proposed Road Charge Would Piggyback On California S Plans For A Per Mile Driver Fee The San Diego Union Tribune

The Current Irs Mileage Rate See What Mileage Rates For This Year

California Employers Association 2022 Irs Mileage Rate Is Up From 2021

Use Our Rate Calculator To Budget For Mileage Reimbursement Costs

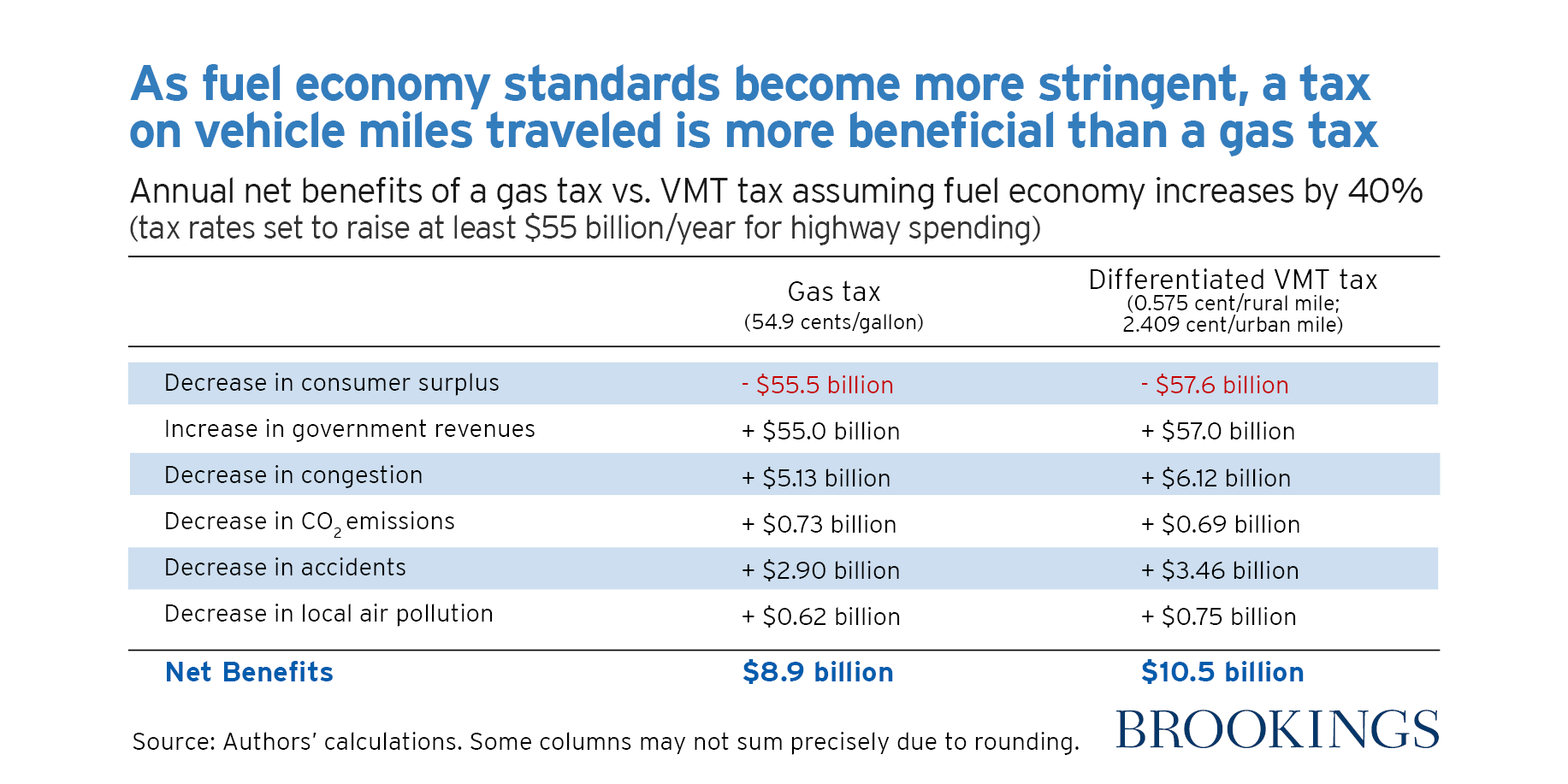

Ditching The Gas Tax Switching To A Vehicle Miles Traveled Tax To Save The Highway Trust Fund

The Current Irs Mileage Rate See What Mileage Rates For This Year

2021 Irs Business Mileage Rate Of 56 Cents Calculated Using Motus Data